Introduction: Your Journey Into Crypto Starts Now

If you’ve ever thought you’re too late for crypto — you’re not. Whether you missed Bitcoin at $100 or Ethereum at $10, the truth remains: crypto investing in 2025 is more accessible, educational, and strategic than ever before. With institutional adoption accelerating, regulatory clarity improving, and AI tools democratizing market research, now is an ideal time for beginners to enter crypto investing confidently and safely.

This guide is your roadmap. It’s designed for complete beginners — no prior crypto knowledge required. You’ll learn how to set up your first wallet, choose a trusted exchange, build a diversified portfolio, and read market signals like a pro. More importantly, you’ll understand how to manage risk, avoid common pitfalls, and let AI work for you.

Crypto investing isn’t gambling. When done right, it’s a disciplined strategy combining education, patience, and calculated decision-making. Over the next 2,500 words, you’ll discover exactly what it takes to become a confident, informed crypto investor.

What Is Cryptocurrency? Understanding the Fundamentals

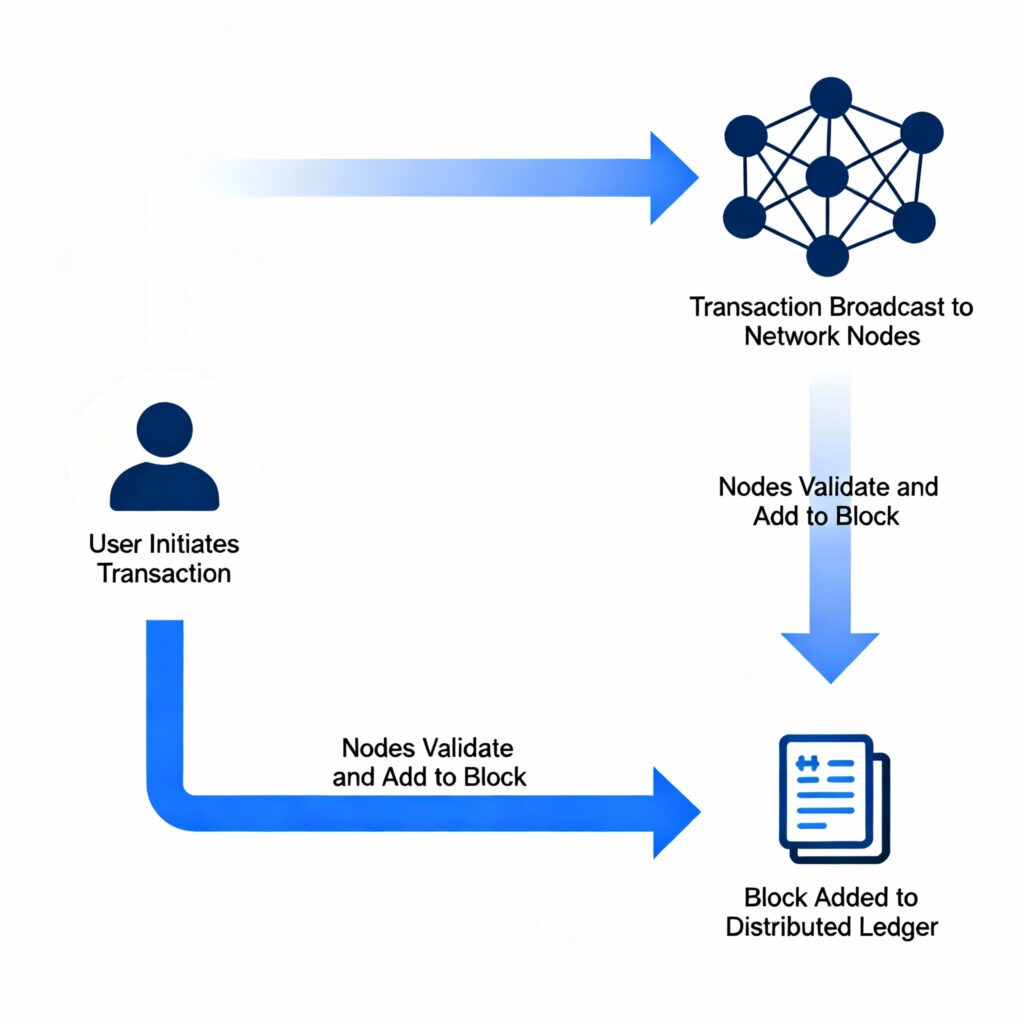

Before you invest, you need to understand what you’re investing in. Think of cryptocurrency as digital money that runs on blockchain technology — a public ledger distributed across thousands of computers worldwide.

Bitcoin, created in 2009, is the original cryptocurrency and the most recognized. It’s designed as “digital gold” — a store of value with a fixed supply of 21 million coins. Ethereum, launched in 2015, is different: it’s a platform that runs smart contracts and decentralized applications (dApps). Unlike Bitcoin’s primary focus on payments, Ethereum enables entire ecosystems of finance, gaming, and art to exist on-chain.

The key difference lies in function: Bitcoin answers “How do we store value digitally?” Ethereum answers “How do we build complex applications without central authorities?”

2025 Crypto Trends You Should Know

Tokenization: Real-world assets (real estate, bonds, commodities) are being converted into digital tokens. This is the bridge between traditional finance and crypto.

Layer-2 Scaling: Solutions like Arbitrum and Optimism make transactions faster and cheaper while settling on Ethereum for security.

RWA (Real-World Assets): Billions in traditional assets are entering blockchain, making crypto more tangible and regulated.

Understanding these trends helps you spot emerging opportunities and avoid chasing outdated narratives. Crypto isn’t static — it evolves, and informed investors evolve with it.

How Crypto Investing Works: Trading vs Investing

There’s a critical distinction beginners often miss: trading and investing are not the same.

Traders buy and sell frequently, often within hours or days, trying to capture price movements. They use technical analysis, charts, and live market data. Trading requires constant attention and emotional discipline — one wrong move can wipe out gains in seconds.

Investors buy quality assets and hold for months or years, believing in the technology and long-term adoption. They ride volatility rather than fight it. Investing is passive, less stressful, and historically more profitable.

As a beginner, investing is your best path. Why? Because you’re not competing against algorithms and professional traders with million-dollar setups. You’re playing a game you can actually win: long-term wealth building.

Short-Term vs Long-Term Strategies

Short-term (months to a year): You’re betting on price movements driven by news, adoption, or market cycles. Higher risk, but potential for quick gains.

Long-term (3-5+ years): You’re betting on adoption and real-world use. Bitcoin and Ethereum have survived multiple bear markets because they solved real problems. Lower stress, historically better returns.

The Power of Dollar-Cost Averaging (DCA)

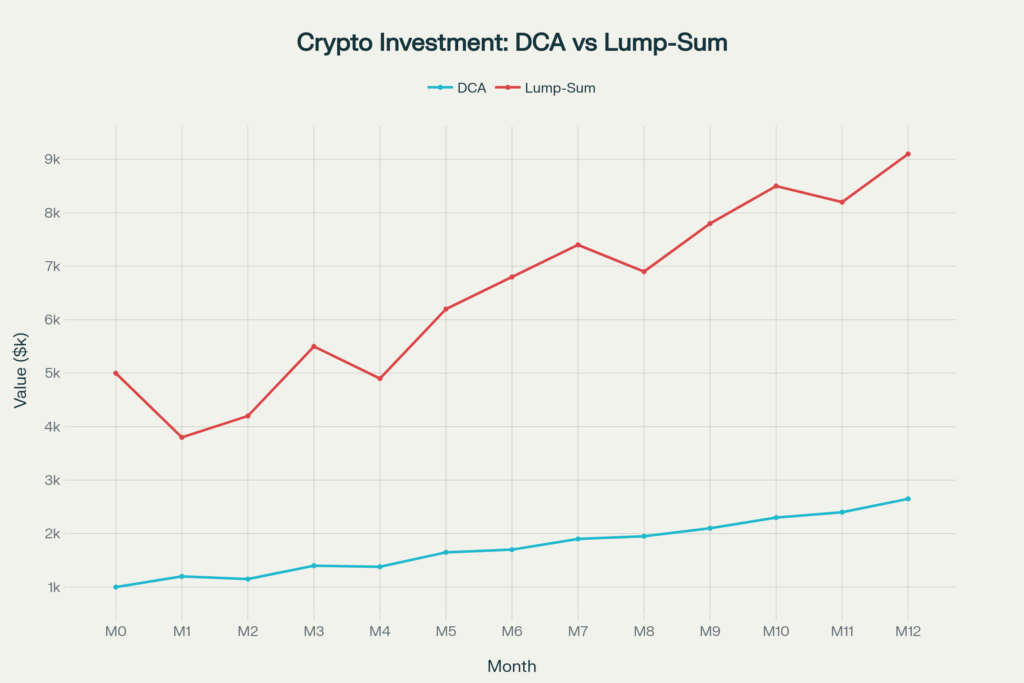

Imagine you want to buy $10,000 worth of Bitcoin. Should you buy it all at once, or spread purchases over time?

Dollar-Cost Averaging (DCA) means investing a fixed amount regularly (e.g., $500 every week for 20 weeks). This strategy removes the pressure of timing the market perfectly. When prices are high, your $500 buys fewer coins. When prices are low, it buys more. Over time, this balances out to a favorable average price.

The chart below shows why beginners love DCA: consistent, predictable growth with less emotional turbulence.

Setting Up for Success: Exchanges, Wallets, and Security

You’ve decided to invest. Now comes the practical part: where and how?

Choosing a Trusted Exchange

An exchange is where you convert fiat currency (dollars, euros, etc.) into crypto. Reputable exchanges include:

- Coinbase: Beginner-friendly, strong security, available globally.

- Binance: Highest trading volume, advanced features, regulatory scrutiny in some regions.

- Kraken: Excellent customer support, strong security record, good for US users.

- Crypto.com: Good for earning rewards, user-friendly interface.

What to look for:

- Regulation: Is the exchange licensed in your country?

- Security: Do they use 2FA (two-factor authentication) and cold storage for reserves?

- Fees: Know what they charge for deposits, trades, and withdrawals.

- Liquidity: Can you buy/sell large amounts without slippage?

Start with an exchange you trust. As you grow, you might use multiple exchanges for diversification.

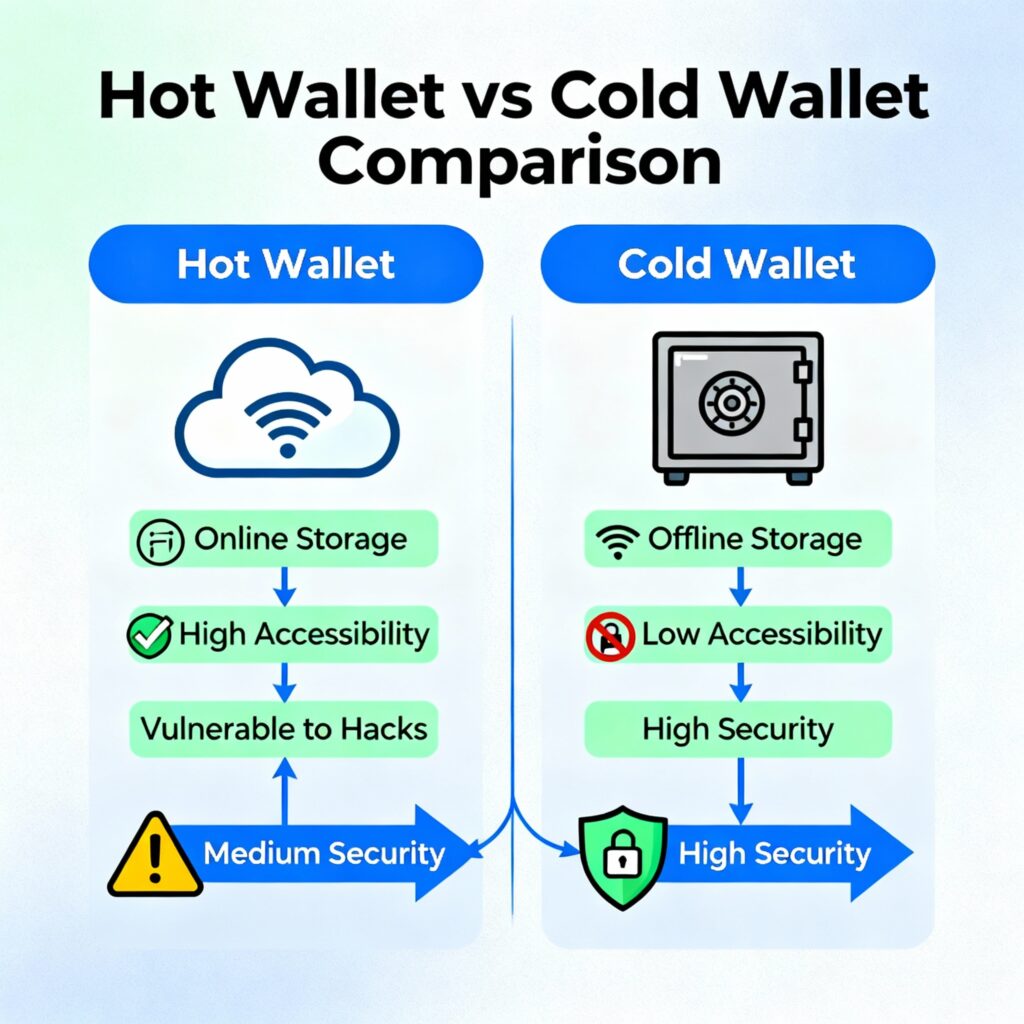

Understanding Wallets: Custodial vs Non-Custodial

Your exchange account is convenient but not fully yours — the exchange controls your private keys (think: the password that proves ownership). This is called a custodial wallet. It’s safe for small amounts, but not ideal long-term.

A non-custodial wallet (like MetaMask, Ledger, or Trezor) puts you in control. You hold the private keys. If the wallet company goes bankrupt, your crypto is still yours. If you lose your keys, your crypto is lost forever.

For beginners: Start with a custodial exchange, then move larger holdings to a non-custodial wallet as you learn.

The Non-Negotiable Security Rules

💡 Tip: Your recovery phrase (usually 12-24 words) is the master key to your wallet. Treat it like your most valuable possession.

- Write your seed phrase on paper. Store it somewhere secure — a safe, safety deposit box, or hidden at home.

- Never screenshot your seed phrase or store it on your computer.

- Enable two-factor authentication (2FA) on every account.

- Bookmark exchanges correctly; phishing sites mimic real ones.

- Test small transactions first before moving large amounts.

⚠️ Warning: “If it sounds too good to be true — it probably is.” 99% of crypto scams prey on greed and urgency.

Building Your First Crypto Portfolio

Now for the strategy part. What should you actually buy?

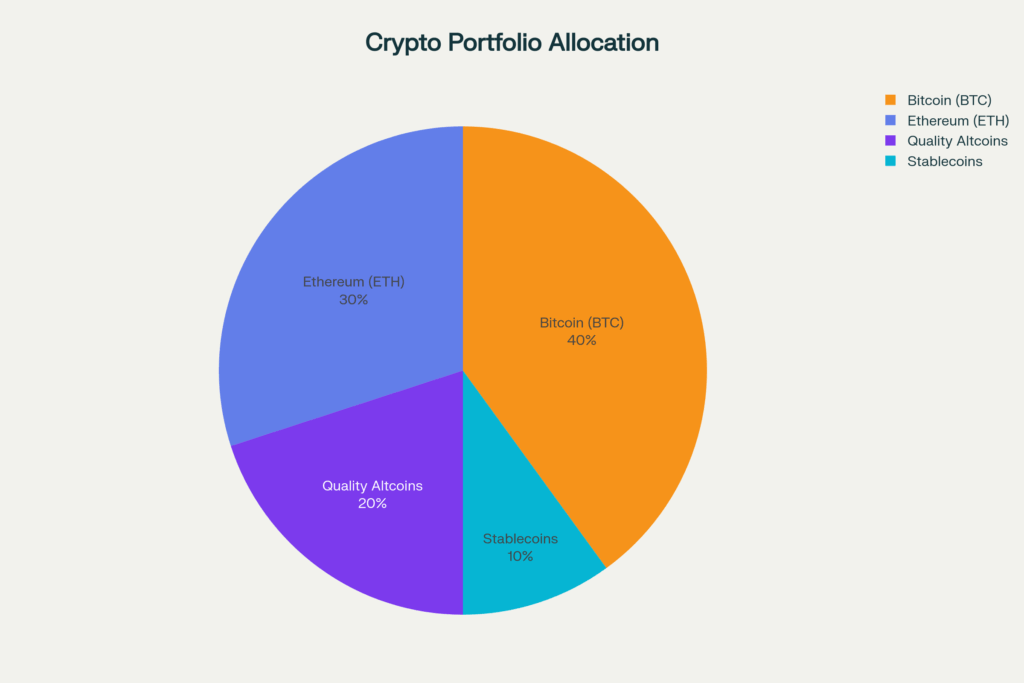

The Three-Layer Approach

Layer 1 (70%): Core Holdings

- Bitcoin (BTC): 40-50% — the most established, least risky.

- Ethereum (ETH): 20-30% — the leading smart contract platform.

These two alone can form a solid foundation. They’ve survived multiple bear markets, have the strongest developer ecosystems, and represent the bulk of crypto adoption.

Layer 2 (20%): Secondary Assets

- Quality altcoins solving real problems (Solana for speed, Chainlink for data, Polygon for scaling).

- Stablecoins (USDC, USDT) for dry powder and risk management.

Layer 3 (<10%): Experimental

- Emerging narratives: AI tokens, DeFi protocols, or Layer-2 tokens.

- Only invest what you can afford to lose completely.

Example: $1,000 Beginner Portfolio

- Bitcoin: $400 (40%)

- Ethereum: $300 (30%)

- Solana/Chainlink/Polygon: $200 (20%)

- Stablecoins: $100 (10%)

This allocation gives you exposure to crypto’s best-performing assets while limiting risk. Over time, if Bitcoin rises to 60% of your portfolio, you might rebalance by selling some BTC and buying alts — a discipline called portfolio rebalancing.

Reading the Market: Technical Analysis for Beginners

Charts can look intimidating, but they tell stories. Learn to read them, and you’ll spot trends before most people.

Three Essential Indicators

RSI (Relative Strength Index): Measures momentum on a scale of 0-100.

- Above 70 = Overbought (price likely to fall).

- Below 30 = Oversold (price likely to rise).

- Use it to avoid buying at peaks.

MACD (Moving Average Convergence Divergence): Combines two moving averages to show trend direction.

- When the MACD line crosses above the signal line = potential uptrend.

- When it crosses below = potential downtrend.

- Think of it as momentum confirmation.

EMA200 (200-Day Exponential Moving Average): The long-term trend line.

- Price above EMA200 = in an uptrend.

- Price below EMA200 = in a downtrend.

- Use it to filter out short-term noise.

💡 Tip: Focus on trend, not noise. A chart showing Bitcoin above its EMA200, RSI between 40-70, and MACD bullish = conditions favor buying. Ignore daily micro-movements.

On-Chain Data: The Secret Weapon

Charts show price history; on-chain data shows real activity. Tools like Glassnode and DefiLlama reveal:

- Large transfers: Whales moving coins signal conviction or fear.

- Exchange flows: Coins moving to exchanges = selling pressure. Moving off exchanges = accumulation.

- Active addresses: Growing usage suggests adoption.

- Network value: Market cap relative to transaction volume.

Professional investors use this data constantly. As a beginner, you don’t need to obsess, but checking major signals before making big decisions is smart.

Managing Risk and Mastering Emotions

Crypto volatility is extreme. Bitcoin can swing 10-20% in a day. This tests emotions like nothing else.

The Golden Rules of Risk Management

Rule 1: Only Invest What You Can Afford to Lose

This isn’t cliché — it’s foundational. If losing your entire crypto investment would impact your bills, rent, or emergency fund, you’ve invested too much. Crypto should come from discretionary income.

Rule 2: Diversify

Don’t put all your money in one coin. Don’t put all your crypto in one exchange. Spread risk across assets, platforms, and storage methods.

Rule 3: Use Stop-Losses

A stop-loss sells your asset if the price drops below a certain level. If you buy Bitcoin at $50,000, a 20% stop-loss at $40,000 limits your damage. Most exchanges support this.

Rule 4: Avoid Leverage Early

Leverage (borrowed money) magnifies gains and losses. For beginners, stay in the spot market (buying and holding). Leverage is how accounts get liquidated overnight.

Understanding Market Psychology

FOMO (Fear of Missing Out): You see a coin up 100% and panic-buy at the peak. Then it crashes 50%, and you panic-sell at the bottom. FOMO is expensive.

FUD (Fear, Uncertainty, Doubt): Negative news sends you into panic selling, just before a recovery.

Impatience: You expect 10x returns in a month. When it doesn’t happen, you abandon ship.

The solution? Have a plan before you invest. Write down: Why am I buying this? How long am I holding? What’s my sell signal? When emotions spike, your plan is your anchor.

Using AI Tools for Smarter Investing

This is 2025. Crypto moves 24/7, but you can’t watch it constantly. AI can.

How to Leverage AI for Crypto Investing

ChatGPT & Gemini: Market Research

Ask these tools to summarize recent developments in a project, analyze tokenomics, or explain complex protocols. They save hours of research.

Example: “Summarize the recent Ethereum Shanghai upgrade and explain how it affects ETH holders.”

TradingView & Alerts: Technical Monitoring

Set up price alerts and chart patterns. When Bitcoin breaks above your resistance level, get a notification.

n8n Automation: Portfolio Workflow

Build automated workflows:

- Monitor Twitter for whale alerts.

- Track portfolio performance hourly.

- Send daily reports to your email.

- Automatically rebalance when assets drift from target allocation.

The AI-Powered Workflow

Your workflow might look like this:

- Gemini generates a daily market analysis.

- ChatGPT extracts key altcoin updates.

- TradingView alerts notify you of price breaks.

- n8n automatically logs this data and updates your spreadsheet.

- You spend 15 minutes reviewing everything and making decisions.

What used to take 3 hours now takes 15 minutes. AI handles data; you handle strategy.

💡 Tip: Let AI do the data work. You focus on high-level decisions: buy or sell, rebalance or hold.

Staying Safe in Crypto: Security and Scam Prevention

Crypto’s decentralized nature is powerful and dangerous. There’s no “undo” button. Once your coins leave your wallet, they’re gone forever.

Common Scams and How to Avoid Them

Fake Tokens: Scammers create tokens with names similar to legitimate projects (e.g., “Ethereium” instead of “Ethereum”). You buy them, they pump then dump, and you lose everything.

Prevention: Always verify contract addresses on official websites. Use CoinMarketCap or CoinGecko — never trust unknown sources.

Phishing Sites: Clones of real exchanges designed to steal your login credentials.

Prevention: Bookmark exchanges carefully. Always type URLs manually. Never click links from emails or social media.

Rug Pulls: Developers launch a project, hype it, then disappear with the money.

Prevention: Check project transparency. Real projects have public teams, audited code, and gradual development milestones.

Fake Airdrops: “Connect your wallet for free coins.” Your wallet suddenly empties.

Prevention: Never connect your wallet to unknown websites. Use a separate burner wallet for testing.

Your Security Checklist

- ✅ Use exchanges with strong regulatory oversight.

- ✅ Enable 2FA on all accounts.

- ✅ Store seed phrases offline in a safe place.

- ✅ Verify contract addresses before buying.

- ✅ Test small transactions before moving large amounts.

- ✅ Use hardware wallets (Ledger, Trezor) for 5+ figures.

- ✅ Check project audits on CertiK or OpenZeppelin.

Common Mistakes Beginners Make (And How to Avoid Them)

Learning from others’ mistakes is free tuition.

Top 5 Beginner Mistakes

1. Panic Selling

You buy Bitcoin at $50,000. It drops to $40,000. You panic and sell, locking in a loss. Two weeks later, it’s back to $55,000. You missed the recovery because you abandoned your plan. Lesson: Have conviction. If you did research before buying, trust your research.

2. Chasing Pumps

You see a coin up 50% in a week. FOMO hits hard. You buy at the peak. It crashes 80%. You’re wiped out. Lesson: The best gains happen before you hear about them. If it’s already pumped, the momentum is likely over.

3. Ignoring Security

You store your seed phrase in a Notes app on your phone. Your phone gets hacked. Your crypto is gone. Lesson: Security isn’t optional. Treat it as non-negotiable.

4. No Investment Plan

You throw money at random coins hoping to get rich. No strategy, no research, no stops. Lesson: Investing is a discipline. Before buying anything, answer: Why? How long? What’s my exit?

5. Overleveraging

You borrow money to buy more crypto. The market dips 10%. Your position liquidates. You’re down more than you invested. Lesson: Only use money you own. Leverage is for experienced traders, not beginners.

The Beginner’s DO NOT List

- ❌ Do NOT invest money you need for bills or emergencies.

- ❌ Do NOT use leverage, margin, or futures until you’ve mastered spot trading.

- ❌ Do NOT trust strangers offering “guaranteed returns.”

- ❌ Do NOT store large amounts on exchanges.

- ❌ Do NOT share your seed phrase or private keys with anyone.

- ❌ Do NOT buy into projects just because a celebrity endorses them.

Your Action Plan: Next Steps

Ready to start? Here’s what to do this week:

Day 1: Choose an exchange (Coinbase if you’re in North America, Binance if you’re global). Complete KYC verification.

Day 2: Study the portfolio allocation section above. Decide your allocation: BTC%, ETH%, Alts%, Stablecoins%.

Day 3: Make your first small purchase ($50-100). Get comfortable with the buying process. Move a portion to a hardware wallet if possible.

Day 4: Set up price alerts on TradingView. Subscribe to one reputable crypto newsletter (The Block, Bankless, or Ziqvy’s insights).

Day 5: Join a community (Reddit r/cryptocurrency, Discord servers, Twitter). Learn from others’ experiences.

Week 2: Implement DCA. Invest the same amount weekly or monthly for the next 3-6 months.

Ongoing: Spend 20-30 minutes weekly reviewing your portfolio. Read one educational article. Stay curious.

The Long-Term Mindset: Why Patience Wins

Crypto investing isn’t a sprint — it’s a marathon. The biggest gains go to those who:

- Invest early and hold through volatility: Bitcoin holders from 2015 are up 500,000%+. Those who sold after 30% drawdowns missed everything.

- Keep learning: Crypto changes constantly. The more you learn, the better decisions you make.

- Diversify and rebalance: The best portfolio isn’t the most aggressive — it’s the one you can stick with.

- Avoid emotional decisions: Your plan is your armor against panic and FOMO.

- Use technology (AI tools, automation) to work smarter: Let machines handle data. You handle strategy.

Institutional adoption in 2025 is accelerating. Spot Bitcoin and Ethereum ETFs exist. Governments are creating frameworks. Tokenization is moving real assets on-chain. This isn’t the Wild West anymore — it’s the foundation of future finance.

Your early steps today compound into significant wealth over 5-10 years. The best time to plant a tree was 20 years ago. The second-best time is now.

Conclusion: Your Journey Begins Here

Crypto investing for beginners in 2025 is more accessible than ever. You have wallets that are simple to use, exchanges with regulatory backing, educational resources at your fingertips, and AI tools that would have cost $10,000 a month just a few years ago.

The barrier to entry is gone. What matters now is education, discipline, and patience.

This guide has given you the roadmap: understand what crypto is, set up safely, build a diversified portfolio, read market signals, manage risk, use AI to your advantage, and avoid common pitfalls. But guides are just the beginning — real learning happens through experience.

Your next move: Take the first step. Open an exchange. Make your first purchase. Experience the technology firsthand.

As you grow more confident, you’ll layer on more complex strategies: technical analysis mastery, DeFi protocols, staking, yield farming, governance participation. But those are advanced topics for future lessons.

For now, focus on the fundamentals: buy quality assets, hold for the long term, keep learning, and let time do the work.

Join aicryptobrief’s learning hub for weekly market insights, in-depth tutorials, AI-powered investment tools, and an active community of crypto investors committed to education over hype. Your financial future awaits.

Discover more from aiCryptoBrief.Com

Subscribe to get the latest posts sent to your email.